Why Is it Useful to Have Your Bank Account and Routing Numbers When Using Tax Preparation Software?- Having bank account and routing statistics when using tax preparation software helps indicate where tax refunds should remain sent, showing how much money you have paid in taxes and using them as additional forms of identification.

Table of Contents

Routing vs. Account Number: What’s the Difference?

When you open an account, your bank routing and unique account numbers remain assigned. You can find both at the bottom of paper checks or through your online account. These numbers are also required when making electronic or online transfers. Find out how the numbers are different and how to use them.

Routing Number vs. Account Number

You will need both your bank’s routing and account numbers to perform many financial transactions, such as setting up direct deposit or ordering checks online.

Account numbers remain like customer IDs or fingerprints specific to each account holder. Routing and account numbers remain assigned to indicate precisely where funds for a transaction come and go.

Similarly, routing numbers identify each banking organization with a unique numerical ID. For example, the relevant financial institutions must provide routing and account numbers whenever you make an electronic funds transfer. Routing numbers are nine, and account numbers are typically between nine and 12, although some may be longer.

Route number

The routing number (sometimes called the ABA routing number, short for American Bankers Association) is a nine-digit sequence used by banks to identify specific financial institutions within the U.S. This number proves the bank is a federal or state bank. Authorized institution and maintains an account at the Federal Reserve.

ABA routing numbers remained once used with paper checks, and ACH routing numbers remained associated with electronic account transfers and withdrawals. However, today, most banks use one routing number for all dealings.

When Do I Need My Routing Number?

Why Is it Useful to Have Your Bank Account and Routing Numbers When Using Tax Preparation Software? – Your account and routing numbers remain required for every banking transaction, whether within the bank where the account remains held or between banking institutions.

Small banks generally have a single routing number, while large multinational banks may have several, usually depending on the state in which the account remains held. Routing numbers are often required when reordering checks, for consumer bill payments, to set up direct deposit (such as a payroll check), or for tax payments.

The routing numbers for national and international bank transfers differ from those on your checks. However, they can remain easily obtained online or by communicating with your bank.

Account Number – Why Is it Useful to Have Your Bank Account and Routing Numbers When Using Tax Preparation Software?

The account number works in combination with the routing number. While the routing number identifies the financial organization’s name, the account number (usually between eight and 12 digits) identifies your account. If you have two accounts at a similar bank, the routing numbers will typically remain the same, but your account numbers will differ.

Anyone can find a bank’s routing number, but your account number remains unique to you, so it’s essential to protect it, just as you would your Communal Security number or PIN code.

How to Find Your Account and Routing Numbers

You can find your explanation and routing numbers at the lowest left of paper checks issued from your checking account. Otherwise, you can often find the routing number when logging into an online banking portal.

Because your financial institution’s routing number is not unique to your account, you may be able to find it simply online. Just make sure your bank or credit union owns the website you use.

You can check your bank’s web-site or app if you don’t have a check on hand and need to know your account and routing numbers. When you reach your account, click on the whole account number, which should show you the routing number. After verifying your identity, you can also call your bank and request the routing and bank account numbers.

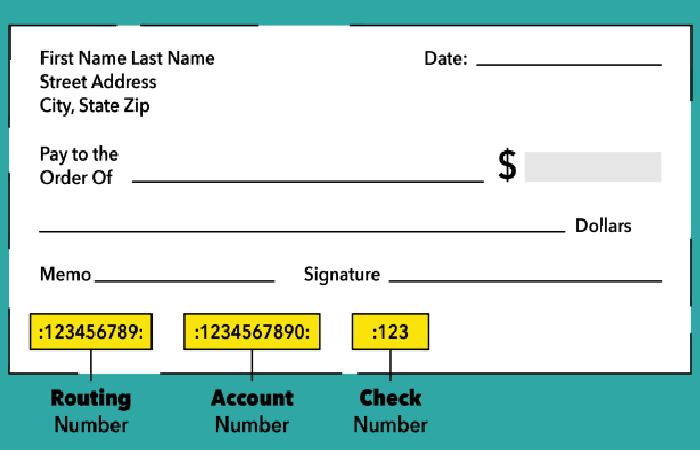

Routing Number Versus Account Number Example

You will see three sets of numbers at the lowest of a check. 9-digit routing numbers typically seem as the first group, account numbers remain the second group, and check numbers remain the third. Sometimes, however, such as on cashier’s checks, those numbers may appear in a different sequence.

This series of numbers remains entrenched with magnetic ink, known as your check’s MICC [magnetic ink character credit] line. Magnetic ink, pronounced “micker,” allows each bank’s processing equipment to read and process explanation information.

How Do I Find My Routing Number and Account Number?

You can find both numbers in a few places, including your checks, bank statements, mobile banking app, or the bank’s website. Routing numbers remain usually printed on the bottom left of your check, and your checking account number will follow.

The Account Number or The Routing Number?

The routing number appears first, followed through the account number. This remains because a routing number is how a financial institution identifies itself and can be used to find your account along with your bank account number.

What Routing Number Do You Use For Direct Deposit?

To accept money from a direct deposit, the person or institute making the deposit will need your bank’s routing and account numbers to receive the funds.

Why Do I Have Two Routing Numbers?

While no two banks have the same routing number, it is not unusual for large financial institutions to have many routing numbers specific to the state or location where your account remains held.

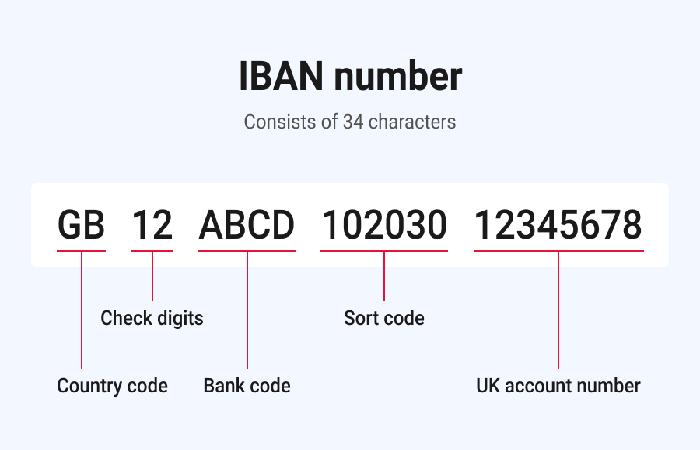

What is an IBAN?

An IBAN remains an international bank account number, a worldwide standard for sending bank payments. It consists of 34 alphanumeric characters identifying the country, bank, branch, and account.

Countries in North America, Australia, and Asia do not use IBAN for domestic money transfers. They will only do so when sending a payment to a country that consumes adopted IBAN.

The bottom line – Why Is it Useful to Have Your Bank Account and Routing Numbers When Using Tax Preparation Software?

You can contact your banking institution if unsure which is between your routing and account number. Always verify both numbers each time you provide them to another party. This will ensure a smooth transaction that avoids delays or associated bank charges resulting from funds ending up in the wrong account.

Related posts

Featured Posts

Vanessa Bryant: Who is She? Vanessa Bryant Net Worth 2021

Vanessa Bryant Net Worth – The mother nationality of Vanessa is the American Vanessa Cornejo Urbieta. However, she was born…

What exactly is Google App Console? – Smart Tech Crunch – 2022

You may expand your Google Play company by using the Google Play App Console to publish your applications and games….